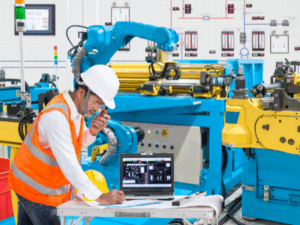

Advanced Instrumentation and Process Control.

Maintained control and measurement in manufacturing procedures helps promote an organization’s overall success. However, it’s easier said than done. Managing the control of a huge variety of procedures can be greatly overwhelming. This is where the process control implementation comes in.

Efficiently using process control techniques at your fingertips allows you and your manufacturing procedures to attain the significant success you have been waiting for. However, it takes a lot of assessment skills and overall discipline to completely understand the variables that are within your manufacturing space. Successful appllication of instrumentation, however, facilitates the delivery of quality results. It allows your business to stay profitable.

This is why we have gathered four reasons why process control will be essential to your business’s success. Ideally, these benefits will show the need of developing a comprehensive insight to your business.

- Process control instrumentation guarantees consistency

Measurements are one of the most substantial parts in a plant. Working with the correct process control instrumentation to rework and remodel your internal operations will allow your instruments to decrease inconsistency and work to the best of their capabilities.

Also, keeps your employees level-headed, well-rested, and most especially, excited to report to work every day. By simply removing unnecessary equipment, or even physical labour, there will be more space and time for the business to grow.

- It lowers labour costs.

One of the greatest benefits of process control industry is automated effectiveness. In fact, it is possible that after you carry out your process control instrumentation and redo your procedures, you will notice less of a need for your current equipment or human labour. There will be more proceeds to go around, which means an upturn in general performance.

- Process control instrumentation enhances quality.

Process control systems are fundamental to preserve product quality. Using correct instrumentation, control systems keep up the right proportion of ingredients, balance temperatures and monitor productions. Without this principle of control, outputs would differ and quality would be harmed.

With enhanced quality comes greater levels of security. Pressure relief valves, for instance, can balance a steam supply. Pressure switches will halt a pump from overheating. This aspect is crucial, as plant safety is top priority in any production.

- There are opportunities for additional business.

By switching focus to cost-efficient and goal-reaching technologies, you will enhance your capability to take on more work. Also, you and your business will evolve into the best versions of yourselves, which then means your clients will see their desires come to fruition, too.

The capacities of your inspection and machining processes, as they carry on to develop through the guidance of now-applied PCIs, will emphatically improve future business for the years to come.

The perfect instrumentation and process control

Want to learn more about instrumentation and process control? Here at Salvo Global, we offer a full range of training services for instrumentation, process control equipment, design and fabrication, sub-assembly, calibration, engineering, and certification.

To sign up to our course, simply click the button below

The course delivered a different dimension to how I perceive internal branding previously and allowed me to study and adept possible new approaches to guide my organization through its corporate transformation efforts.

The training was well organized and I’m looking forward to attend to other courses.

CHOOSE YOUR COURSE

the top popular courses for you

Our Valued Clients

Corporate treasury has never been more critical—or more complex. In an environment defined by heightened volatility, tightening liquidity, refinancing risk, regulatory pressure, and geopolitical uncertainty, the ability to control cash, optimize liquidity, and protect the balance sheet has become a decisive factor in corporate resilience and value creation. Traditional treasury skills alone are no longer sufficient. Today’s finance professionals must master advanced cash visibility, funding strategies, risk management, and technology-enabled decision-making to safeguard the organization and support its strategic objectives. This Masterclass addresses these challenges head-on, equipping participants with the tools and frameworks needed to operate confidently in today’s demanding treasury landscape.

Beyond its core mandate, treasury is increasingly expected to act as a strategic business partner across the organization—supporting growth, enabling transactions, advising on risk, and contributing directly to financial strategy. This intensive 5-day interactive Masterclass is designed for corporate treasurers, cash managers, CFOs, finance leaders, and commercial bankers who need to understand both sides of the treasury equation. Participants gain practical, best-practice insights into world-class treasury operating models, liquidity and working capital optimization, funding structures, and enterprise financial risk management, while also developing a deeper understanding of how treasury collaborates with internal stakeholders and banking partners to deliver measurable value.

What sets this Masterclass apart is its strong practical focus. Through real-world case studies, group exercises, interactive discussions, and worked examples, participants learn how to apply best-practice tools and techniques across all areas of treasury—from cash and liquidity management to technology, ESG considerations, cyber risk, and real-time payments. Delegates leave with actionable methods to improve cash visibility and forecasting accuracy, optimize working capital and balance sheet efficiency, reduce financial and operational risk, and elevate treasury’s strategic contribution to the organization. For professionals committed to building or transforming a truly world-class treasury function, this Masterclass is simply unmissable.

Top Learning Objectives

- Strategic Architecture : Define the value-add of a modern treasury function and distinguish between policy-making, organizational structure, and operational execution.

- Liquidity & Cash Optimization: Master advanced cash pooling, in-house banking (IHB), and multi-currency concentration to maximize internal liquidity.

- Financial Risk Mitigation: Evaluate and deploy financial instruments (Forwards, Swaps, Options) to hedge against FX volatility, interest rate fluctuations, and counterparty risks.

- Banking Ecosystem Management: Analyze how banks evaluate corporate credit to optimize lending terms and leverage new payment technologies (Fintech, AI, and APIs).

- Working Capital Mastery: Benchmark working capital ratios and implement strategies to optimize the “Cash Conversion Cycle” without disrupting supply chain stability.

Who Should Attend?

CFOs, MDs, Treasurers, Assistant Treasurers, Directors of Treasury, VP Finance, Directors, Bankers and Senior Managers responsible for:

- Corporate Treasury

- Cash Management/Liquidity Management

- Foreign Exchange/Interest Rate Risk

- Risk Management/Group Risk Management

- Asset Liability Management

- Working Capital Management

- Bank Product Development

- Bank Marketing

- Bank Sales of Treasury products

- Investment/Debt

- Internal Audit, Finance and Accounting

- Corporate Planning / Internal Controls / Regulatory & Compliance

Trainer's Background

- A Strategic Treasury Leader, M&A Integration Specialist, and Financial Educator with over a decade of experience managing complex treasury operations and multi-billion-euro asset portfolios across Europe’s leading financial centers, including London, Paris, Munich, and Luxembourg.

- He has held senior roles with globally recognized institutions such as SES Satellites, ALPS ALPINE, and CACEIS, where he led treasury integration for major M&A transactions, optimized global liquidity structures, and managed investment and cash portfolios of up to €20 billion.

- Renowned for bridging technical accounting, advanced treasury systems, and strategic corporate finance, Frederik brings deep expertise in funding strategies, risk management, cross-border compliance, and ERP/TMS implementation.

- An accomplished educator, he combines real-world execution with academic excellence, holding an MBA from INSEEC/Sorbonne and a Master’s from EM Lyon, and pursuing advanced legal studies at Paris Sorbonne—making his training both highly practical and strategically insightful.

In today’s volatile and capital-constrained environment, financial decisions around funding, investment, and risk have a direct and lasting impact on enterprise value. This intensive 2-day Corporate Finance course equips professionals with the tools to optimize capital structure, minimize WACC, and enhance shareholder value while making disciplined capital allocation decisions. Participants will gain a rigorous, practical command of investment appraisal techniques such as NPV, IRR, and Payback, ensuring that capital is deployed where it delivers the greatest strategic and financial return.

The course goes beyond theory by focusing on hands-on financial modeling and forward-looking analysis. Participants will learn how to build integrated three-statement financial models in Excel that remain robust under stress-testing and adverse market scenarios. Through sensitivity and scenario analysis, they will develop strategic financial forecasts that quantify risk, assess long-term solvency, and test business resilience—skills that are essential for navigating uncertainty and supporting confident, data-driven decision-making.

What truly sets this course apart is its emphasis on translating financial analysis into strategic impact. Participants will learn how to link operational drivers to financial outcomes, implement value-based management frameworks, and design executive-level dashboards and KPIs that resonate with senior management and Boards. By sharpening their ability to communicate complex financial insights clearly and strategically, finance professionals will leave better equipped to influence decisions, strengthen governance, and position finance as a true strategic partner—making this 2-day course simply unmissable for ambitious finance leaders.

Top Learning Objectives

- Optimize Capital Structure by determining the most effective mix of debt and equity to minimize WACC and enhance shareholder value

- Apply Investment Appraisal Techniques using NPV, IRR, and Payback methods to make disciplined capital allocation decisions.

- Build Integrated Financial Models by constructing robust three-statement models (Income Statement, Balance Sheet, Cash Flow) in Excel.

- Stress-Test Financial Performance to assess business resilience under adverse economic and market conditions.

- Develop Strategic Financial Forecasts incorporating sensitivity and scenario analysis to evaluate long-term solvency and risk.

- Translate Strategy into Financial Outcomes by linking operational drivers to financial results and enterprise value.

- Implement Value-Based Management Frameworks that align financial decision-making with shareholder and stakeholder objectives.

- Design Executive-Level Dashboards and KPIs that support board-level decision-making and strategic oversight.

- Improve Capital Allocation Discipline by prioritizing investments based on risk-adjusted returns and strategic fit.

- Enhance Strategic Financial Communication by clearly presenting complex financial insights to senior management and the Board.

Who Should Attend?

This Corporate Finance training course is suitable for a wide range of people but will particularly suit:

- Financial Managers

- Corporate decision-makers

- Market trends specialists

- Risk and return analysts

- Merger and acquisitions specialists

- Auditors and management accountants

Trainer's Background

- A Strategic Treasury Leader, M&A Integration Specialist, and Financial Educator with over a decade of experience managing complex treasury operations and multi-billion-euro asset portfolios across Europe’s leading financial centers, including London, Paris, Munich, and Luxembourg.

- He has held senior roles with globally recognized institutions such as SES Satellites, ALPS ALPINE, and CACEIS, where he led treasury integration for major M&A transactions, optimized global liquidity structures, and managed investment and cash portfolios of up to €20 billion.

- Renowned for bridging technical accounting, advanced treasury systems, and strategic corporate finance, Frederik brings deep expertise in funding strategies, risk management, cross-border compliance, and ERP/TMS implementation.

- An accomplished educator, he combines real-world execution with academic excellence, holding an MBA from INSEEC/Sorbonne and a Master’s from EM Lyon, and pursuing advanced legal studies at Paris Sorbonne—making his training both highly practical and strategically insightful.

Faced with complicated transmission and distribution systems and limited O&M budgets, utilities are being pressed to optimize their asset management investments while facing heavy scrutiny from both internal and external stakeholders.

Salvo Global’s course focuses on real experiences shared with attendees so they will leave with asset management tools to address problematic system components and justify their maintenance decisions to management, regulators, and external stakeholders. Best practices in asset management and strategic investment decision are at the program’s core and will be discussed throughout with a focus on getting the most out of your assets for the least cost and best value. Developing an asset health monitoring framework for measuring, tracking and monitoring value creation will be highlighted as well.

By completing the Asset Management course, organisations will gain benefits with:

-

- Consistent, prioritised and auditable risk management

- Reduced product and service problems

- Lower operating costs

- Alignment with existing initiatives, including competency development

- Sustainable and robust continuous improvement processes

- Better decision making

- Increased consistency in business practices

- Enhanced employee engagement

- Improved planning

- Overall business improvement

Top Learning Objectives

- Understand the ISO 55001 asset management standard and how to apply it to power transmission and distribution

- Determine minimum technical requirements to achieve transmission reliability & stability

- Develop a customized asset management plan that will compliment your organizations operation

- Utilize criticality matrices as measure of failure impact that focus of safety and environment as critical factors

- Develop and utilize KPI’s to effectively measure asset performance and monitor improvements

- Integrate asset management risk assessment to effectively prioritise critical assets

Who Should Attend?

This course provides participants with the knowledge of how Asset Management approaches and methodologies that are applied in electrical utilities (both transmission and distribution) and is aimed at utility engineers, asset managers and staff dealing with regulatory and financial side of utilities business:

- Asset Managers

- Engineers

- Maintenance Planners & Managers

- Grid Manager

- Reliability Managers

- Filed Supervisors

- Risk Managers

- Project Engineers & Managers

Trainer's Background

A chartered engineer with over 20 years of industry experience, skilled in asset management with experience of major capital projects globally. His main area of focus is on asset management of all facilities across the value chain. He held both engineering and management consultant roles in oil majors, utilities-transmission and distribution and consultancies. He has developed and delivered numerous maintenance, reliability and asset management courses, online and in person and worked with major international universities to support continued professional development.

Dans un environnement caractérisé par une forte volatilité et des contraintes croissantes sur le capital, les décisions liées au financement, à l’investissement et au risque ont un impact direct et durable sur la valeur de l’entreprise. Cette formation intensive de deux jours en finance d’entreprise fournit aux professionnels les outils nécessaires pour optimiser la structure du capital, réduire le CMPC et accroître la valeur actionnariale tout en assurant une allocation disciplinée du capital. Les participants acquerront une maîtrise rigoureuse et pratique des techniques d’évaluation des investissements, garantissant que les ressources financières sont allouées aux projets les plus créateurs de valeur.

La formation va au-delà de la théorie en mettant l’accent sur la modélisation financière appliquée et l’analyse prospective. Les participants apprendront à construire des modèles financiers intégrés à trois états sous Excel, capables de résister à des stress tests et à des scénarios de marché défavorables. Grâce aux analyses de sensibilité et de scénarios, ils développeront des prévisions financières stratégiques permettant de quantifier les risques, d’évaluer la solvabilité à long terme et de renforcer la résilience de l’entreprise.

Ce qui distingue véritablement cette formation est son orientation vers l’impact stratégique. Les participants apprendront à relier les leviers opérationnels aux résultats financiers, à mettre en œuvre des approches de gestion par la valeur et à concevoir des tableaux de bord et indicateurs clés adaptés aux attentes des comités exécutifs et des conseils d’administration. En renforçant leur capacité à communiquer efficacement des analyses financières complexes, les professionnels de la finance repartiront mieux armés pour influencer les décisions stratégiques, renforcer la gouvernance et positionner la fonction finance comme un véritable partenaire stratégique.

Top Learning Objectives

- Optimiser la Structure du Capital en déterminant la combinaison la plus efficace entre dette et fonds propres afin de minimiser le CMPC (WACC) et d’accroître la valeur pour les actionnaires.

- Appliquer des Techniques d’Évaluation des Investissements (VAN/NPV, TRI/IRR et Payback) pour prendre des décisions disciplinées d’allocation du capital.

- Construire des Modèles Financiers Intégrés en développant des modèles financiers robustes à trois états (Compte de résultat, Bilan, Tableau des flux de trésorerie) sous Excel.

- Tester la Résilience Financière par des stress tests afin d’évaluer la capacité de l’entreprise à faire face à des conditions économiques et de marché défavorables.

- Développer des Prévisions Financières Stratégiques intégrant des analyses de sensibilité et de scénarios pour évaluer la solvabilité et les risques à long terme.

- Traduire la Stratégie en Résultats Financiers en reliant les leviers opérationnels à la performance financière et à la valeur de l’entreprise.

- Mettre en Œuvre des Cadres de Gestion par la Valeur alignant les décisions financières sur les objectifs des actionnaires et des parties prenantes.

- Concevoir des Tableaux de Bord et KPI de Niveau Exécutif destinés à soutenir la prise de décision du top management et des conseils d’administration.

- Renforcer la Discipline d’Allocation du Capital en priorisant les investissements selon leur rendement ajusté du risque et leur cohérence stratégique.

- Améliorer la Communication Financière Stratégique en présentant de manière claire et percutante des analyses financières complexes à la Direction Générale et au Conseil.

Who Should Attend?

Cette formation en finance d’entreprise s’adresse à un large public et conviendra particulièrement à :

- Responsables financiers

- Décideurs d’entreprise

- Spécialistes des tendances de marché

- Analystes risque / rendement

- Spécialistes en fusions et acquisitions

- Auditeurs et contrôleurs de gestion

Trainer's Background

- Leader stratégique en trésorerie, spécialiste de l’intégration post-fusion (M&A) et formateur en finance

- Plus de 10 ans d’expérience dans la gestion de trésoreries complexes et de portefeuilles d’actifs de plusieurs milliards d’euros dans les principaux centres financiers européens (Londres, Paris, Munich, Luxembourg)

- Fonctions de premier plan au sein d’institutions de renommée internationale (SES Satellites, ALPS ALPINE, CACEIS)

- Pilotage de l’intégration de la trésorerie lors d’opérations majeures de fusions-acquisitions (M&A)

- Optimisation des structures de liquidité globale

- Gestion de portefeuilles de trésorerie et d’investissement pouvant atteindre 20 milliards d’euros

- Expertise approfondie en financement, gestion des risques, conformité transfrontalière et implémentation ERP/TMS

- Formateur accompli, alliant expérience opérationnelle et excellence académique/span>

- Diplômes/formation : MBA (INSEEC/Sorbonne) ; Master (EM Lyon) ; études juridiques avancées en cours à la Sorbonne

0